| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

| ☒ | No fee required. | ||||

| |||||

| |||||

| |||||

| |||||

| |||||

| ☐ | Fee paid previously with preliminary materials. | ||||

| ☐ | 14a-6(i)(1) and | ||||

| |||||

| |||||

| |||||

0-11. | |||||

3535 General Atomics Court, Suite 20012278 Scripps Summit Drive

San Diego, CA 9212192131

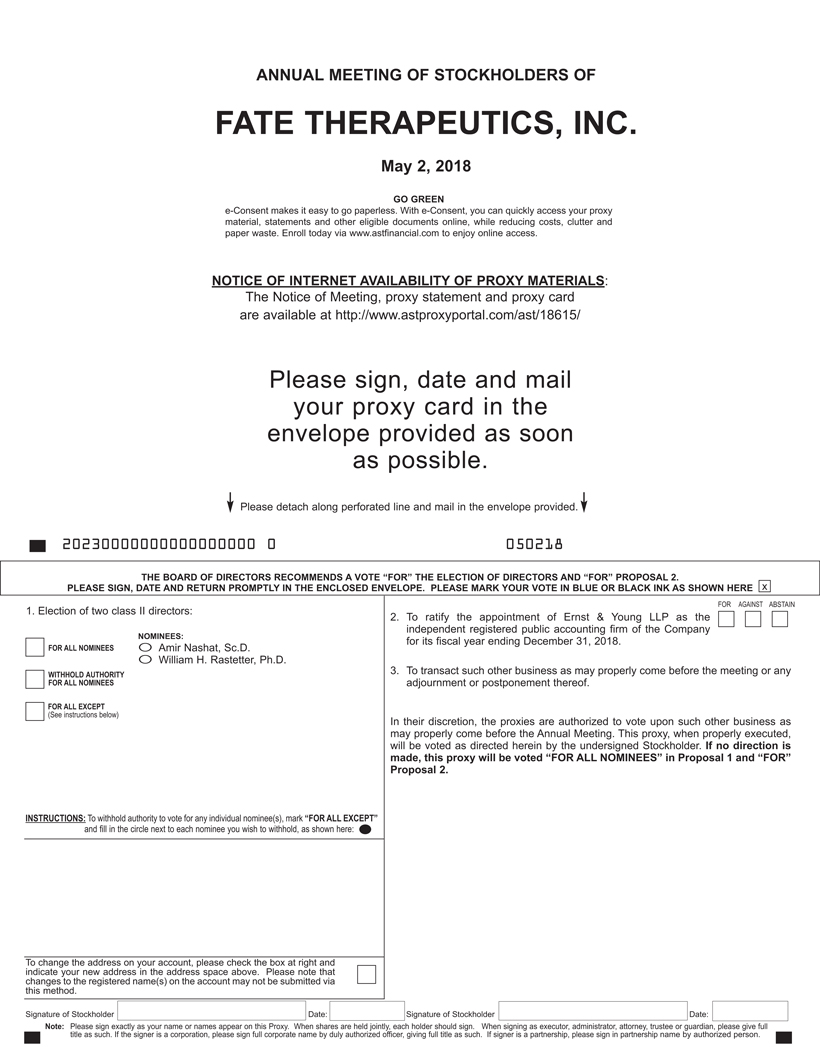

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 2, 2018June 7, 2024

TheDear Stockholder,

You are invited to attend the 2024 Annual Meeting of Stockholders of Fate Therapeutics, Inc. (the “Company” or “our,” and the meeting, the “Annual Meeting”). The Annual Meeting will be held on Wednesday, May 2, 2018Friday, June 7, 2024, at 8:9:00 a.m. local time,Pacific Time, at the offices of Fate Therapeutics, Inc., 3535 General Atomics Court, Suite 200,12278 Scripps Summit Drive, San Diego, CA 92121,California, 92131.

The Annual Meeting will be held for the following purposes:

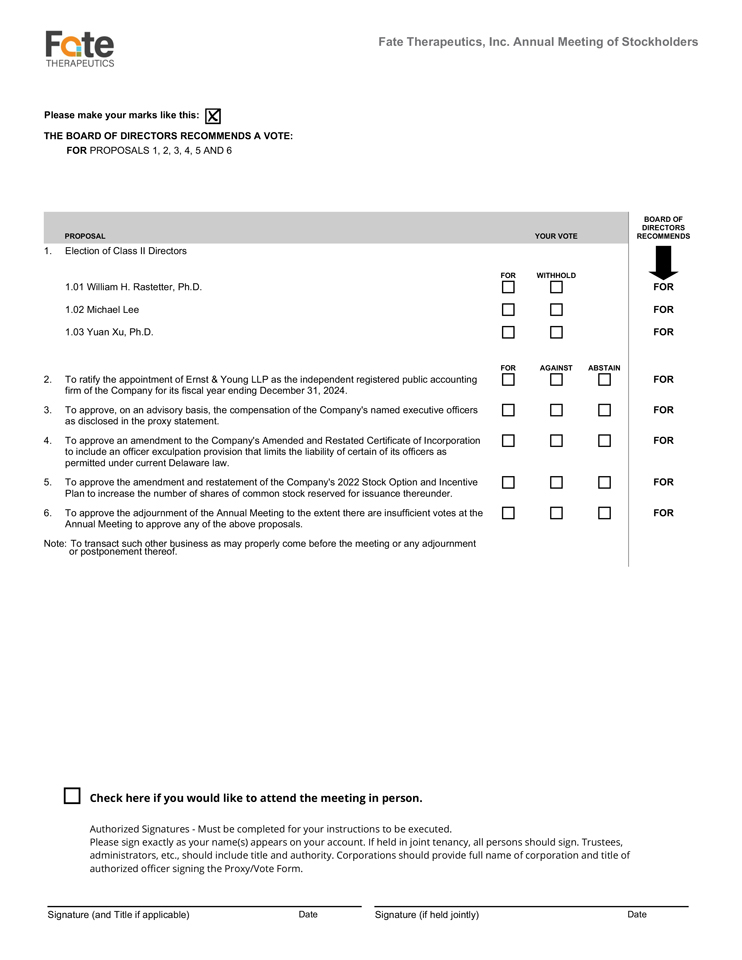

| 1. | To elect |

| 2. | To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, |

| 3. | To |

| 4. | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to include an officer exculpation provision that limits the liability of certain of our officers as permitted under current Delaware law; |

| 5. | To approve the amendment and restatement of the Company’s 2022 Stock Option and Incentive Plan to increase the number of shares of common stock reserved for issuance thereunder; |

| 6. | To approve the adjournment of the Annual Meeting to the extent there are insufficient votes at the Annual Meeting to approve any of the above proposals; and |

To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

These items of business are more fully described in the Proxy Statement accompanying this Notice.

Proposal 1 relates solely to the election of twothree Class II directors nominated by the Board of Directors and does not include any other matters relating to the election of directors, including without limitation, the election of directors nominated by any stockholder of the Company. With respect to the election of the Class II directors, Mark J. Enyedy will not stand for reelection to the Board of Directors at the annual meeting. Mr. Enyedy has served on our Board of Directors since 2012, and we thank him for his years of service.

The Board of Directors has fixed the close of business on Monday, March 5, 2018Tuesday, April 9, 2024, as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting, of Stockholders, or at any adjournments of the Annual Meeting of Stockholders.Meeting.

In order to ensure your representation at the Annual Meeting, of Stockholders, you are requested to submit your proxy as instructed in the Important Notice Regarding the Availability of Proxy Materials that you received in the mail. You may also request a paper proxy card at any time before April 20, 2018May 24, 2024 to submit your vote by mail. If you attend the Annual Meeting of Stockholders and file with the Secretary of the Company an instrument revoking your proxy or a duly executed proxy bearing a later date, your proxy will not be used.

All stockholders are cordially invited to attend the Annual Meeting of Stockholders.Meeting.

By Order of the Board of Directors

Fate Therapeutics, Inc.

/s/ J. Scott Wolchko

J. Scott Wolchko

President and Chief Executive Officer

San Diego, California

March 16, 2018April 26, 2024

Your vote is important, whether or not you expect to attend the Annual Meeting of Stockholders.Meeting. You are urged to vote either via the Internet or telephone, as instructed in the Important Notice Regarding the Availability of Proxy Materials that you received in the mail. Voting promptly will help avoid the additional expense of further solicitation to assure a quorum at the meeting.

FATE THERAPEUTICS, INC.

FOR THE ANNUAL MEETING OF STOCKHOLDERS

May 2, 2018June 7, 2024

INFORMATION CONCERNING SOLICITATION AND VOTING

General

This proxy statement (“Proxy Statement”) is furnished in connection with the solicitation of proxies for use prior to or at the 20182024 Annual Meeting of Stockholders (the “Annual Meeting”) of Fate Therapeutics, Inc. (the “Company”), a Delaware corporation, to be held at 8:9:00 a.m. local timePacific Time on Wednesday, May 2, 2018Friday, June 7, 2024, at the offices of Fate Therapeutics, Inc., 12278 Scripps Summit Drive, San Diego, California, 92131, and at any adjournments or postponements thereof for the following purposes:

To elect twothree Class II directors, as nominated by the Company’s Board of Directors (“Board of Directors” or “Board”), to hold office until the 20212027 Annual Meeting of Stockholders or until their successors are duly elected and qualified;

To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2018;2024;

| • | To conduct a non-binding advisory vote to approve the compensation of our named executive officers; |

To approve a proposal to amend the Company’s Amended and Restated Certificate of Incorporation to include an officer exculpation provision that limits the liability of certain of our officers as permitted under current Delaware law;

To approve a proposal to amend and restate the Company’s 2022 Stock Option and Incentive Plan (the “2022 Plan”) to increase the number of shares of common stock reserved for issuance thereunder;

To approve the adjournment of the Annual Meeting to the extent there are insufficient votes at the Annual Meeting to approve any of the above proposals; and

To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The Annual Meeting will be held at the offices of the Company, 3535 General Atomics Court, Suite 200, San Diego, CA 92121. On or about March 16, 2018,April 26, 2024, we intend to mail to all stockholders entitled to vote at the Annual Meeting a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this Proxy Statement and our 20172023 Annual Report onForm 10-K (“Annual Report”).

Solicitation

This solicitation is made on behalf of the Board of Directors. We will bear the costs of preparing, mailing, online processing and other costs of the proxy solicitation made by our Board of Directors. Certain of our officers and employees may solicit the submission of proxies authorizing the voting of shares in accordance with the Board of Directors’ recommendations. Such solicitations may be made by telephone, facsimile transmission, email or personal solicitation. No additional compensation will be paid to such officers, directors or regular employees for such services. We will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonableout-of-pocket expenses incurred by them in sending proxy materials to stockholders.

1

Important Notice Regarding the Availability of Proxy Materials

In accordance with rules and regulations of the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each stockholder of record, the Company may furnish proxy materials via the internet. Accordingly, all of the Company’s stockholders will receive a Notice, to be mailed on or about March 16, 2018.April 26, 2024.

On the date of mailing the Notice, stockholders will be able to access all of the proxy materials on the website at www.astproxyportal.com/ast/18615.www.proxydocs.com/FATE. The proxy materials will be available free of charge. The Notice will instruct you as to how you may access and review all of the important information contained in the proxy materials (including the Annual Report) over the internet or through other methods specified on the website. The

website contains instructions as to how to vote by internet or over the telephone. The Notice also instructs you as to how you may request a paper or email copy of the proxy card. If you received a Notice and would like to receive printed copies of the proxy materials, you should follow the instructions for requesting such materials included in the Notice.

Voting Rights and Outstanding Shares

Only holders of record of ourthe Company’s common stock as of the close of business on March 5, 2018April 9, 2024 are entitled to receive notice of, and to vote at, the Annual Meeting. Each holder of our common stock will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting. At the close of business on March 5, 2018,April 9, 2024, there were 52,772,056113,816,708 shares of our common stock issued and outstanding.

A quorum of stockholders is necessary to take action at the Annual Meeting. Stockholders representing a majority of the outstanding shares of our common stock issued, outstanding and entitled to vote on any matter (present in personat the Annual Meeting or represented by proxy) will constitute a quorum. We will appoint an inspector of elections for the meeting to determine whether or not a quorum is present and to tabulate votes cast by proxy or in person at the Annual Meeting. Abstentions, withheld votes and brokernon-votes (which occur when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular matter because such broker, bank or other nominee does not have discretionary authority to vote on that matter and has not received voting instructions from the beneficial owner) are counted as present for purposes of determining the presence of a quorum for the transaction of business at the Annual Meeting.

If you are a beneficial owner of shares held in a brokerage account and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. Under the rules of the New York Stock Exchange, which are also applicable to Nasdaq-listed companies, brokers, banks and other securities intermediaries that are subject to New York Stock Exchange rules may use their discretion to vote your “uninstructed” shares on matters considered to be “routine” under New York Stock Exchange rules but not with respect to “non-routine” matters. Proposals 1, 3, 4, 5 and 6 are considered to be “non-routine” such that your broker, bank or other agent may not vote your shares on those proposals in the absence of your voting instructions. Conversely, Proposal 2 is considered to be “routine” and thus if you do not return voting instructions to your broker, your shares may be voted by your broker in its discretion on Proposal 2.

Votes Required for Each Proposal

To elect our directors and approve the other proposals being considered at the Annual Meeting, the voting requirements are as follows:

| ||||

| ||||

|

“DiscretionaryVotingPermitted” means that brokers will have discretionary voting authority with respect to shares held in street name for their clients, even if the broker does not receive voting instructions from their client.

“Majority” means a majority of the votes properly cast for and against such matter.

“Plurality” means a plurality of the votes properly cast on such matter. For the election of directors, the two nominees receiving the plurality of votes entitled to vote and cast will be elected as directors.

The vote required and method of calculation for the proposals to be considered at the Annual Meeting are as follows:

ProposalOne—ElectionofDirectors. If a quorum is present, the three director nominees receiving the highest number of affirmative votes properly cast, submitted in person or by proxy, will be elected as directors. You may vote “FOR” all nominees, “WITHHOLD” for allone or more nominees or “WITHHOLD” for any nomineefrom one or more nominees by specifying the name of theyour vote for each nominee on your proxy card. This proposal is not considered to be a “routine” item under the rules of the

2

New York Stock Exchange, so if you do not instruct your broker how to vote with respect to this proposal, your broker may not vote on this proposal, and those votes will be counted as broker “non-votes.”Withheld votes and brokernon-votes will have no effect on the outcome of the election of the directors. Our charter and our bylaws do not provide for cumulative voting in the election of directors.

ProposalTwo—ApprovaloftheRatificationofErnst &Young LLPas the IndependentRegisteredPublicAccountingFirm. Approval of this proposal requires the affirmative vote of a majority of the votes properly cast for and against such matter. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. If you abstain from voting on this matter, your shares will not be counted as “votes cast” with respect to such matter,

and the abstention will have no effect on the proposal. BrokerThis proposal is considered to be a “routine” item under the rules of the New York Stock Exchange, and your broker will be able to vote on this proposal even if it does not receive instructions from you. Accordingly, we do not anticipate that there will be any broker non-votes on this proposal; however, any broker non-votes will have no effect on the proposal.

Proposal Three—Non-Binding Advisory Vote to Approve the Compensation of Our Named Executive Officers. Approval of this non-binding advisory proposal requires the affirmative vote of a majority of the votes properly cast for and against such matter. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. If you abstain from voting on this matter, your shares will not be counted as “votes cast” with respect to such matter and therefore an abstention will therefore have no effect on the proposal. This proposal is not considered to be a “routine” item under the rules of the New York Stock Exchange, which are also applicable to Nasdaq-listed companies, brokers, banks and other securities intermediaries that are subject to New York Stock Exchange rules, so if you do not instruct your broker how to vote with respect to this proposal, your broker may not vote on this proposal, and those votes will be counted as broker “non-votes.” Broker non-votes will have no effect on the outcome of this proposal.

Proposal Four—Approval of Amendment to Our Amended and Restated Certificate of Incorporation to Include an Officer Exculpation Provision. Approval of this proposal requires the affirmative vote of a majority of the outstanding shares of common stock entitled to vote on the matter. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. Abstentions are considered shares present and entitled to vote on this proposal and therefor an abstention will have the same effect as a vote “AGAINST” this proposal. This proposal is not considered to be a “routine” item under the New York Stock Exchange, so if you do not instruct your broker how to vote with respect to this proposal, your broker may not vote on this proposal, and those votes will be counted as broker “non-votes.” Broker non-votes have the same effect as a vote “AGAINST” this proposal.

Proposal Five—Approval of Amendment and Restatement of Our 2022 Stock Option and Incentive Plan to Increase the Number of Shares of Common Stock Reserved for Issuance Thereunder. Approval of this proposal requires the affirmative vote of a majority of the votes properly cast for and against such matter. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. If you abstain from voting on this matter, your shares will not be counted as “votes cast” with respect to such matter and therefore an abstention will have no effect on the proposal. This proposal is not considered to be a “routine” item under the rules of the New York Stock Exchange, so if you do not instruct your broker how to vote with respect to this proposal, your broker may not vote on this proposal, and those votes will be counted as broker “non-votes.” Broker non-votes will have no effect on the outcome of this proposal.

Proposal Six—Approval of the adjournment of the Annual Meeting to the extent there are insufficient votes at the Annual Meeting to approve any of the above proposals. Approval of this proposal requires the affirmative vote of a majority of the votes properly cast for and against such matter. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. If you abstain from voting on this matter, your shares will not be counted as “votes cast” with respect to such matter and therefore an abstention will have no effect on the proposal. This proposal is not considered to be a “routine” item under the rules of the New York Stock Exchange, so if you do not instruct your broker how to vote with respect to this proposal, your broker may not vote on this proposal, and those votes will be counted as broker “non-votes.” Broker non-votes will have no effect on the outcome of this proposal.

3

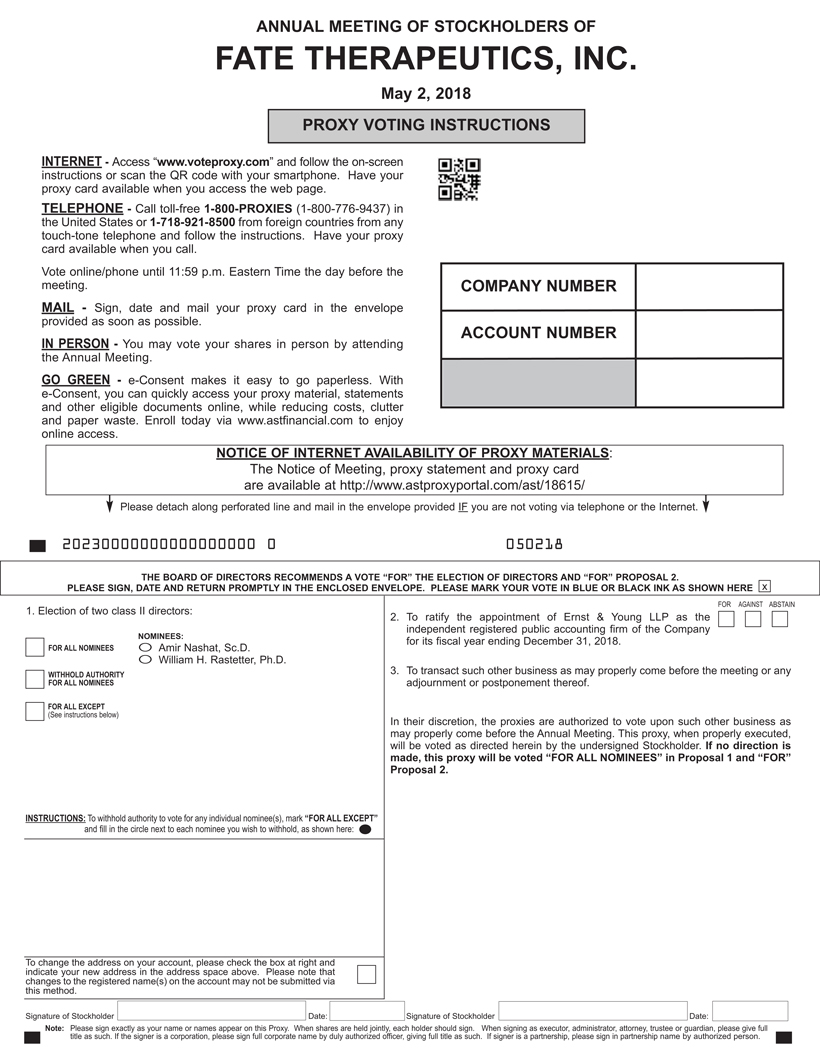

We request that you vote your shares by proxy following the methods as instructed by the Notice: over the Internet, by telephone or by mail. If you choose to vote by mail, your shares will be voted in accordance with your voting instructions if the proxy card is received prior to or at the Annual Meeting. If you sign and return your proxy card but do not give voting instructions, your shares will be voted FOR (i) the election of each of the Company’s two (2)three (3) nominees as Class II directors; (ii) the ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm forof the Company for the fiscal year ending December 31, 2018;2024; (iii) the approval, on a non-binding, advisory basis, of the compensation of our named executive officers; (iv) the approval of an amendment to Fate Therapeutics, Inc. Amended and (iii)Restated Certificate of Incorporation to include an officer exculpation provision that limits the liability of certain of our officers as permitted under current Delaware law; (v) the approval of an amendment and restatement of the Fate Therapeutics, Inc. 2022 Stock Option and Incentive Plan to increase the number of shares reserved for issuance under the 2022 Plan by 8,000,000 shares; and (vi) as the proxy holder deems advisable, in his or her discretion, on other matters that may properly come before the Annual Meeting.

Voting by Proxy Overover the Internet or by Telephone

Stockholders whose shares are registered in their own names may vote by proxy by mail, over the Internet or by telephone. Instructions for voting by proxy over the Internet or by telephone are set forth on the Notice. The Internet and telephone voting facilities will close at 11:59 p.m. EasternPacific Time on Tuesday, May 1, 2018.Thursday, June 6, 2024. The Notice will also provide instructions on how you can elect to receive future proxy materials electronically or in printed form by mail. If you choose to receive future proxy materials electronically, you will receive an email next year with instructions containing a link to the proxy materials and a link to the proxy voting site. Your election to receive proxy materials electronically or in printed form by mail will remain in effect until you terminate such election.

If your shares are held in street name, the voting instruction form sent to you by your broker, bank or other nominee should indicate whether the institution has a process for beneficial holders to provide voting instructions over the Internet or by telephone. A number of banks and brokerage firms participate in a program that also permits stockholders whose shares are held in street name to direct their vote over the Internet or by telephone. If your bank or brokerage firm gives you this opportunity, the voting instructions from the bank or brokerage firm that accompany this Proxy Statement will tell you how to use the Internet or telephone to direct the vote of shares held in your account. If your voting instruction form does not include Internet or telephone information, please complete and return the voting instruction form in the self-addressed, postage-paid envelope provided by your broker. Stockholders who vote by proxy over the Internet or by telephone need not return a proxy card or voting instruction form by mail, but may incur costs, such as usage charges, from telephone companies or Internet service providers.

Revocability of Proxies

Any proxy may be revoked at any time before it is exercised by filing an instrument revoking it with the Company’s Secretary or by submitting a duly executed proxy bearing a later date than such proxy prior to the time of the Annual Meeting. Stockholders who have voted by proxy over the Internet or by telephone or have executed and returned a proxy and who then attend the Annual Meeting and desire to vote in person are requested to notify the Secretary in writing prior to the time of the Annual Meeting. We request that all such written notices of revocation to the Company be addressed to Cindy R. Tahl, Secretary, c/o Fate Therapeutics, Inc., at the address of our principal executive offices at 3535 General Atomics Court, Suite 200,12278 Scripps Summit Drive, San Diego, CA 92121.92131. Our telephone number is(858) 875-1800. Stockholders may also revoke their proxy by entering a new vote over the Internet or by telephone.

Voting Results

We plan to announce preliminary voting results at the Annual Meeting and will publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Annual Meeting.

4

Stockholder Proposals to be Presented at the Next Annual Meeting

Any stockholder who meets the requirements of the proxy rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), may submit proposals to the Board of Directors to be presented at the 20192025 annual meeting. Such proposals must comply with the requirements ofRule 14a-8 under the Exchange Act and

be submitted in writing by notice delivered or mailed by first-class United States mail, postage prepaid, to our Secretary at our principal executive offices at the address set forth above no later than November 16, 2018December 27, 2024 in order to be considered for inclusion in the proxy materials to be disseminated by the Board of Directors for such annual meeting. If the date of the 20192025 annual meeting is moved by more than 30 days from the date contemplated at the time of the previous year’s proxy statement, then notice must be received within a reasonable time before we begin to print and send proxy materials. If that happens, we will publicly announce the deadline for submitting a proposal in a press release or in a document filed with the U.S. Securities and Exchange Commission (the “SEC”).SEC. A proposal submitted outside the requirements ofRule 14a-8 under the Exchange Act will be considered untimely if received after January 30, 2019.March 12, 2025.

Our Amended and Restated Bylaws (“Bylaws”) also provide for separate notice procedures to recommend a person for nomination as a director or to propose business to be considered by stockholders at a meeting. To be considered timely under these provisions, the stockholder’s notice must be received by our Secretary at our principal executive offices at the address set forth above no earlier than January 2, 2019February 7, 2025 and no later than February 1, 2019.March 9, 2025. Our Bylaws also specify requirements as to the form and content of a stockholder’s notice.

In addition to satisfying the foregoing requirements, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than April 8, 2025. Stockholder proposals and the required notice submitted by mail should be addressed to our Secretary at our principal executive offices at the address set forth above.

The Board of Directors, a designated committee thereof or the chairman of the meeting may refuse to acknowledge the introduction of any stockholder proposal if it is not made in compliance with the applicable notice provisions.

ELECTION OF DIRECTORS

General

Our certificate of incorporation provides for a Board of Directors that is divided into three classes. The term for each class is three years, staggered over time. This year, the term of the directors in Class II expires. TwoEach of our current Class II directors except for Dr. Robert Hershberg will each stand forre-election at the Annual Meeting. One of our Class II directors, Mr. Mark Enyedy, will not standfor re-election at the Annual Meeting. Our Board of Directors is currently comprised of seven members and will adjust to six members as of the date of the annual meeting.ten members. If botheach of the Class II director nominees areis elected at the Annual Meeting, the composition of our Board of Directors will be as follows: Class I—Drs. Robert S. Epstein, and John D. Mendlein;Mendlein and Karin Jooss; Class II—Drs. Amir Nashat and William H. Rastetter;Rastetter and Yuan Xu, and Mr. Michael Lee; and Class III—Dr. Shefali Agarwal, and Messrs. J. Scott Wolchko and Timothy P. Coughlin.

In the absence of instructions to the contrary, the persons named as proxy holders in the accompanying proxy intend to vote in favor of the election of the nominees designated below to serve until the 20212027 Annual Meeting of Stockholders and until their successors shall have been duly elected and qualified. Each nominee is currently a director. The Board of Directors expects that each nominee will be available to serve as a director, but if any such nominee should become unavailable or unwilling to stand for election, it is intended that the shares represented by the proxy will be voted for such substitute nominee as may be designated by the Board of Directors.

Robert Hershberg, M.D., Ph.D. will not stand for re-election as a director at the Annual Meeting, and, accordingly, the size of the Board of Directors will be reduced from ten directors to nine directors effective immediately following the Annual Meeting. This decision was made in consultation with Dr. Hershberg and was not due to any performance issues or any disagreement relating to our operations, policies, or practices. We would like to thank Dr. Hershberg for his years of service on our Board of Directors. With Dr. Hershberg’s departure, and the Board of Directors’ corresponding reduction in the number of directors serving at that time, the Board of Directors intends to continue its ongoing review of its composition.

The biographies of our directors and their ages as of MarchApril 1, 20182024 are set forth below.

Name | Age | Position | ||||||||

J. Scott Wolchko | President, Chief Executive Officer and Director | |||||||||

William H. Rastetter, Ph.D.(1) | Chairman of the Board of Directors | |||||||||

John D. Mendlein, Ph.D., J.D. | Vice Chairman of the Board of Directors | |||||||||

Timothy P. Coughlin(1)(2) | ||||||||||

| Director | |||||||||

Robert S. Epstein, M.D., M.S. | Director | |||||||||

| 61 | Director | ||||||||

Michael Lee | 45 | Director | ||||||||

Karin Jooss, Ph.D.(2) | 59 | Director | ||||||||

Dr. Shefali Agarwal(3) | 50 | Director | ||||||||

Yuan Xu, Ph.D.(2) | 56 | Director | ||||||||

| (1) | Member of the Audit Committee of the Board of Directors (the “Audit Committee”). |

| (2) | Member of the Compensation Committee of the Board of Directors (the “Compensation Committee”). |

| (3) | Member of the Nominating and Corporate Governance Committee of the Board of Directors (the “Nominating and Corporate Governance Committee”). |

6

Nominees for Director

Class II:

The Board of Directors recommends that you vote FOR the following nominees.

The persons listed below are nominated for election to Class II of the Board of Directors to serve a three-year term ending at the 20212027 Annual Meeting of Stockholders and until their successors are elected and qualified.

AmirNashat,Sc.D.WilliamH.Rastetter,Ph.D. has served as a director since September 2007. He has served as the Chief Executive Officer of Jnana Therapeutics, a company that operates a drug discovery platform focused on solute carrier, since September 2017. He is also a Managing General Partner at Polaris Venture Partners, a venture capital firm. He joined Polaris in April 2002 and focuses on investments in healthcare, consumer products and energy. Dr. Nashat currently represents Polaris as a director of BIND Therapeutics, Inc. and as a director of aTyr Pharma, Inc., both biopharmaceutical companies, as well as a director of several private companies. Additionally, Dr. Nashat has served as a director of Adnexus Therapeutics (acquired by Bristol-Myers Squibb Company) and other private

companies. Dr. Nashat holds a Sc.D. in chemical engineering from the Massachusetts Institute of Technology with a minor in biology, and an M.S. and B.S. in materials science and mechanical engineering from the University of California, Berkeley.

The Board of Directors believes that Dr. Nashat is qualified to serve on our Board of Directors due to his extensive experience within the field of drug discoverysince November 2011 and development, his broad leadership experience on various boards, and his financial expertise with life sciences companies.

WilliamH.Rastetter,Ph.D. has served as Chairman of theour Board and a directorof Directors since NovemberDecember 2011. From February 2012 to October 2012, he also served as our interim Chief Executive Officer. He is aCo-Founder of Receptos, Inc., a biopharmaceutical company that is a wholly-owned subsidiary of Celgene, Corporation, where he served as a director and Chairman of the Boardboard of directors from 2009 to 2015, and was Acting Chief Executive Officer from May 2009 to November 2010. Dr. Rastetter also served as the Chairman of Illumina, Inc. (“Illumina”) from 2005 to 2016, as a director of Illumina Inc. from 1998 to 2016. He was a founding director, interim Chief Executive Officer, and Chairman of Grail, Inc. which was acquired by Illumina in 2021. Dr. Rastetter currently serves as the Chairman of Neurocrine Biosciences, Inc., as the Chairman of Grail, Inc. (Nasdaq: NBIX), as a director of Regulus Therapeutics, Inc. (Nasdaq: RGLS), and as a directorChairman of Daré Bioscience, Inc. (Nasdaq: DARE), previously known as Cerulean Pharma, Inc. He also serves ason the board of directors of Iambic, Inc., a strategic advisor to Leerink Partners, a healthcare focused investment bank,privately held company, and as an advisor to Illumina Ventures, a genomics focused venture firm. Dr. Rastetter served as a Partner at the venture capital firm of Venrock from 2006 to February 2013. Prior to that, Dr. Rastetter was Executive Chairman of Biogen Idec, from the merger of the two companies (Biogen and Idec Pharmaceuticals) in 2003 through the end of 2005. He joined Idec Pharmaceuticals at its founding in 1986 and served as Chairman and Chief Executive Officer. At Idec Pharmaceuticals he was a co-inventor of rituximab, the first monoclonal antibody approved by the FDA for cancer therapy. Prior to Idec Pharmaceuticals, he was director of Corporate Ventures at Genentech, Inc. (“Genentech”) and also served in a scientific capacity at Genentech. Dr. Rastetter held various faculty positions at the Massachusetts Institute of Technology and Harvard University and was an Alfred P. Sloan Fellow. Dr. Rastetter holds a Ph.D. and M.A. in chemistry from Harvard University and an S.B. in chemistry from the Massachusetts Institute of Technology.

The Board of Directors believes Dr. Rastetter is qualified to serve on our Board of Directors due to his extensive experience in the biotechnology industry, his broad leadership experience with Idec Pharmaceuticals and on several boards of biotechnology companies, and his experience with financial matters.

Current Class II Director Not Standing forRe-Election

MarkJ.EnyedyMichael Lee has served as a director since July 2012.2018. Mr. Enyedy is PresidentLee has served as Co-Founder and Chief Executive Officer and a director of ImmunoGen, Inc.,Portfolio Manager at Redmile Group, LLC (“Redmile”) since 2007. Prior to Redmile, Mr. Lee worked as a biotechnology company, positions he has held since May 2016. Prior to joining ImmunoGen,investor at Steeple Capital, and as an analyst at Welch Capital Partners and Prudential Equity Group. Mr. Lee currently serves on the board of directors of IGM Biosciences, Inc., (Nasdaq: IGMS) and Shattuck Labs, Inc. (Nasdaq: STTK) Mr. Enyedy served in various executive capacities at Shire plc, a biopharmaceutical company, from 2013 to May 2016, including as Executive Vice President and head of Corporate Development from 2014 to 2016, where he lead Shire’s strategy, M&A and corporate planning functions and provided commercial oversight of Shire’spre-Phase 3 portfolio. Prior to Shire, from September 2011 to July 2013, Mr. Enyedy served as Chief Executive Officer and director of Proteostasis Therapeutics, Inc., a biopharmaceutical company. Prior to Proteostasis, he served 15 years with Genzyme Corporation, a biotechnology company, most recently as President of the Transplant, Oncology and Multiple Sclerosis divisions. Before joining Genzyme, Mr. Enyedy was an associate in the business law department at Palmer & Dodge. Mr. EnyedyLee holds a J.D. from Harvard Law School and a B.S. in criminal justiceMolecular and Cellular Biology from Northeastern University. the University of Arizona.

The Board of Directors believedhas determined that Mr. Enyedy’sLee’s extensive strategic, operationalbusiness and businessleadership experience with life sciences companies qualifiedin the biotechnology industry qualifies him to serve as a member of our Board of Directors.

Class III: Currently Serving Until the 2019 Annual Meeting

TimothyP.CoughlinYuan Xu, Ph.D. has beenserved as a director since August 2013. He2021. She has served as Chief Financial Officeran independent director on the board of Neurocrine Biosciences,directors of Akero Therapeutics, Inc. (Nasdaq: AKRO) since April 2021, and as an independent director on the board of directors of Xilio Therapeutics, Inc. (Nasdaq: XLO), a biotechnology company, since January 2022. Previously, she served as a board member and Chief Executive Officer for Legend Biotech Co. from March 2018 to August 2020, playing a leading role in its initial public offering. Dr. Xu’s prior career as a senior executive includes Senior Vice President leading Merck’s Biologics & Vaccines subdivision from August 2015 to August 2017, as well as leading biopharmaceutical development and manufacturing groups for Gilead, Novartis and GlaxoSmithKline. In her early career, Dr. Xu held various scientific, regulatory and operations roles at Amgen, Chiron and Genentech. Dr. Xu received a B.S. in biochemistry from Nanjing University and a Ph.D. in biochemistry from the University of Maryland, and she completed her postdoctoral training in virology and gene therapy at the University of California, San Diego.

7

The Board of Directors believes Dr. Xu is qualified to serve on our Board of Directors due to her long-standing track record of executive and scientific leadership in biopharmaceutical research, development, manufacturing, commercialization and life-cycle management.

Class II Director Not Standing for Election at the Annual Meeting

Robert Hershberg, M.D., Ph.D. has served as a director since May 2020. Dr. Hershberg has served as the Chief Executive Officer, President and Chair of the board of directors of HilleVax, Inc. (“HilleVax”) since January 2021 and is currently a Venture Partner at Frazier Healthcare Partners since March 2020. He also served as the Executive Vice President and Head of Business Development and Global Alliances at Celgene Corporation (“Celgene”), a global biopharmaceutical company (acquired by Bristol-Myers Squibb in 2019) from April 2017 to March 2020. He was employed in positions of ascending responsibility at Celgene since joining the company in 2014 including his role as Chief Scientific Officer. Prior to Celgene, Dr. Hershberg served several roles at VentiRx Pharmaceuticals, a clinical-stage biopharmaceutical company which he co-founded in 2006, and was Chief Executive Officer from September 2006 to2012 until the company’s acquisition by Celgene in February 2017, where he previously served as Vice President, Controller. Mr. Coughlin2017. Dr. Hershberg currently serves on the board of directors of Retrophin,Adaptive Biotechnologies Corp. (Nasdaq: ADPT), Recursion Pharmaceuticals, Inc. (Nasdaq: RXRX), and aTyr Pharma, Inc., both biotechnology companies. Prior to joining Neurocrine in 2002,HilleVax (Nasdaq: HLVX) (where he was with Catholic Health

Initiatives,serves as chief executive officer). He is also an independent board member of Cajal Neuroscience, a nationwide integrated healthcare delivery system, where he served as Vice President, Financial Services. Mr. Coughlin also served as a Senior Manager in the Health Sciences practice of Ernst & Young LLP and its predecessors from 1989 to 1999. Mr. Coughlinprivately held company. He holds a master’sPh.D. in biology from the University of California, San Diego’s Affiliated Ph.D. program with the Salk Institute and an M.D. and Bachelor’s degree in international business from San Diego Statethe University and a bachelor’s degree in accounting from Temple University. Mr. Coughlin is a certified public accountant in bothof California, and Pennsylvania.Los Angeles.

The Board of Directors believes Mr. Coughlinthat Dr. Hershberg is qualified to serve on our Board of Directors due to his extensive background in financial and accounting matters for public companiesbroad leadership experience on various boards and his leadership experience in the biotechnology industry, including his tenure at Neurocrine.industry.

J.ScottWolchko has served as our President and Chief Executive Officer since December 2015, and as a director since October 2015. Mr. Wolchko has also served as our Chief Operating Officer since February 2013 and as our Chief Financial Officer since the commencement of our operations in September 2007. Mr. Wolchko began his career in 1994 as an investment banker with Morgan Stanley & Co., serving in the firm’s New York City and Menlo Park, California offices. As a member of the firm’s Investment Banking Health Care Group, he assisted emerging growth companies in the life sciences sector complete capital-raising and M&A transactions. Prior to joining us, from July 2001 to September 2007, Mr. Wolchko served as the Chief Financial Officer of Bocada, Inc., an enterprise software company that specializes in data protection management. Mr. Wolchko holds an M.S. in biochemical engineering from the University of Virginia, and a B.S. in biomedical engineering from the University of Vermont.

The Board of Directors believes Mr. Wolchko’s extensive leadership, executive, managerial, business and healthcare industry experience qualifies him to serve as a member of our Board of Directors. In addition, Mr. Wolchko’sday-to-day management and intimate knowledge of our business and operations provide our Board with anin-depth understanding of the Company.

Class I: Currently Serving Until the 20202026 Annual Meeting

RobertS.Epstein,M.D.,M.S. has served as a member of our Board of Directorsdirector since March 2014. Dr. Epstein is an epidemiologist and strategic consultant to life sciences companies and serves as a director onchairman of the boardsboard of directors of Veracyte, Inc. (Nasdaq: VCYT), a molecular diagnostic company, and a member of the board of directors of Illumina, Inc. (Nasdaq: ILMN), a life sciences company, Proteus Digital Health, Inc., a healthcare technology company, and Mindstrong Health, a digital platform company. From August 2010 to April 2012, Dr. Epstein served as presidentPresident of theMedco-UBC Division and Chief Research and Development officerOfficer of Medco Health Solutions, Inc. (“Medco”), a managed healthcare company. In this role, Dr. Epstein was responsible for all of Medco’s clinical research initiatives, including the Medco Research Consortium and United BioSource Corporation. Dr. Epstein served as Senior Vice President and Chief Medical Officer from 1997 to August 2010 at Medco and was appointed President of the Medco Research Institute in 2009. Before joining the private sector, Dr. Epstein was trained as an epidemiologist and held various positions in public health and academia. He is a past elected President of the International Society of Pharmacoeconomics and Outcomes Research and has served on the board of directors for the Drug Information Association. In 2008, Dr. Epstein was nominated and elected to the Federal CDC EGAPP (Evaluation of Genomic Applications in Practice & Prevention) Stakeholder Committee, and the AHRQ CERT (Centers for Education and Research on Therapeutics) Committee. Dr. Epstein holds a B.S. and an M.D. from the University of Michigan and an M.S. from the University of Maryland.

The Board of Directors has determined that Dr. Epstein’s extensive operating, commercial, and senior management experience in the biotechnology industry, as well as his expertise in health economics, qualifies him to serve as a member of our Board of Directors.

JohnD.Mendlein,Ph.D.,J.D. has served as our Vice Chairman of the Board of Directors since November 2011 and a director since April 2008.2008, and previously served as the founding Chairman of our Board of Directors and as our Chief Science Officer. Dr. Mendlein has served as an Executive Partner of Flagship Pioneering, an innovation firm, since February 2019, and he serves on the board of directors of Omega Therapeutics, Inc. (Nasdaq: OMGA), a clinical-stage biotechnology company. Previously, Dr. Mendlein served as President,

8

Corporate and Product Strategy, of Moderna, Inc. (formerly known as Moderna Therapeutics, Inc.) (“Moderna”), a clinical stage biotechnologybiopharmaceutical company, sincefrom January 2018. He also previously served as our

Chief Executive Officer, as well as the founding Chairman of the Board and Chief Science Officer.2018 to February 2019. Dr. Mendlein also servesserved as a member of the boardChief Executive Officer of aTyr Pharma, Inc., a biopharmaceutical company, a position he has held since July 2010, and served as its Chief Executive Officer from September 2011 to November 2017. From July 2010 to December 2015, Dr. Mendlein also2017, and served as Executive Chairman of theits board of directors for aTyr Pharma, Inc.from July 2010 to December 2015. He also holdsheld board positions with Axcella Health, Inc., an amino acid biologics company, The BIO (Biotechnology Industry Organization) emerging companies board, Editas Medicine, Inc., a genome editing company, and Moderna Therapeutics, Inc.Moderna. Dr. Mendlein previously served from 2005 to 2008 as the Chief Executive Officer of Adnexus Therapeutics, Inc., a biopharmaceutical company, which was purchased by Bristol-Myers Squibb (BMY)(“BMY”) in 2008. Dr. Mendlein also served on the board of directors of Monogram Biosciences, Inc., an HIV and oncology diagnostic company that was acquired by Laboratory Corporation of America Holdings in 2009. Before that, he served as Chairman and Chief Executive Officer of Affinium Pharmaceuticals Ltd. (acquired by Debiopharm Group) from 2000 to 2005, and board member, General Counsel and Chief Knowledge Officer at Aurora Bioscience Corporation (acquired by Vertex Pharmaceuticals, Inc.) from August 1996 to September 2001. Dr. Mendlein holds a Ph.D. in physiology and biophysics from the University of California, Los Angeles, a J.D. from the University of California Hastings College of the Law, San Francisco and a B.S. in biology from the University of Miami.

The Board of Directors has determined that Dr. Mendlein’s extensive business and leadership experience in the biotechnology industry qualifies him to serve as a member of our Board of Directors.

Karin Jooss, Ph.D. has served as a director since March 2019. She has served as Executive Vice President of Research and Chief Scientific Officer of Gritstone Bio, Inc. (“Gritstone”) (formerly Gritstone Oncology, Inc.) (Nasdaq: GRTS), a clinical-stage biotechnology company developing cancer and infectious disease immunotherapies, since April 2016, and as Executive Vice President and Head of R&D since March 2021. Prior to Gritstone, from May 2009 to April 2016, Dr. Jooss served as head of cancer immuno-therapeutics in the vaccine immuno-therapeutics department at Pfizer, Inc. (“Pfizer”), a public pharmaceutical company, where she was also a member of the vaccine immuno-therapeutics leadership team and served as head of the immuno-pharmacology team. Prior to joining Pfizer, Dr. Jooss served as Vice President of research at Cell Genesys, Inc. (“Cell Genesys”), from June 2005 to April 2009, and as Senior Director of Research at Cell Genesys from July 2001 to June 2005. She is on the editorial board of Molecular Therapy and the Journal of Gene Medicine and is a member of the Immunology and Educational Committee of the American Society of Gene & Cell Therapy and the Industry Task Force of the Society for Immunotherapy of Cancer. Dr. Jooss received her diploma in theoretical medicine and a Ph.D. in molecular biology and immunology from the University of Marburg in Germany, and performed postgraduate work in gene therapy and immunology at the University of Pennsylvania.

The Board of Directors believes Dr. Jooss is qualified to serve on our Board of Directors due to her extensive experience in the biotechnology industry.

Class III: Currently Serving Until the 2025 Annual Meeting

TimothyP.Coughlin has served as a director since August 2013. Mr. Coughlin is the former Chief Financial Officer of Neurocrine Biosciences, Inc. (“Neurocrine”), a biopharmaceutical company that has received FDA approval for INGREZZA® (valbenazine) and ORILISSA® (elagolix), both of which were discovered and developed during his tenure at Neurocrine from 2002 to 2018. Mr. Coughlin is Chairman of the board of directors of aTyr Pharma, Inc. (Nasdaq: LIFE) and also serves on the board of Travere Therapeutics, Inc. (Nasdaq: TVTX), and also served on the board of directors of Peloton Therapeutics, Inc. prior to its sale to Merck in 2019. Prior to joining Neurocrine, he was with Catholic Health Initiatives, a nationwide integrated healthcare delivery system, where he served as Vice President of Financial Services. Mr. Coughlin also served as a Senior Manager in the Health Sciences practice of Ernst & Young LLP and its predecessors from 1989 to 1999. Mr. Coughlin holds a master’s degree in international business from San Diego State University and a bachelor’s degree in accounting from Temple University. Mr. Coughlin is a certified public accountant in both California and Pennsylvania.

9

The Board of Directors believes Mr. Coughlin is qualified to serve on our Board of Directors due to his extensive background in financial and accounting matters for public companies and his leadership experience in the biotechnology industry, including his tenure at Neurocrine.

J.ScottWolchko has served as our President and Chief Executive Officer since December 2015, as a director since October 2015, and as our Chief Operating Officer since February 2013. Mr. Wolchko also served as our Chief Financial Officer from the commencement of our operations in September 2007 until August 2020. Mr. Wolchko began his career in 1994 as an investment banker with Morgan Stanley & Co., serving in the firm’s New York City and Menlo Park, California offices. As a member of the firm’s Investment Banking Health Care Group, he assisted emerging growth companies in the life sciences sector complete capital-raising and M&A transactions. Prior to joining us, from July 2001 to September 2007, Mr. Wolchko served as the Chief Financial Officer of Bocada, Inc., an enterprise software company that specializes in data protection management. Mr. Wolchko holds an M.S. in biochemical engineering from the University of Virginia, and a B.S. in biomedical engineering from the University of Vermont.

The Board of Directors believes Mr. Wolchko’s extensive leadership, executive, managerial, business and healthcare industry experience qualifies him to serve as a member of our Board of Directors. In addition, Mr. Wolchko’s day-to-day management and intimate knowledge of our business and operations provide our Board of Directors with an in-depth understanding of the Company.

Dr. Shefali Agarwal has served as a director since July 2019. Dr. Agarwal currently serves as the President and Chief Executive Officer and Chair of the board of directors of Valerio Therapeutics S.A. (formerly Onxeo S.A.) (“Valerio”), a clinical stage biotechnology company developing drugs targeting DNA Damage Response, where she has served as Chair of the board of directors since June 2021. Dr. Agarwal currently serves as chairperson of the compensation committee of the board of directors of Gritstone Bio, Inc. (“Gritstone”) (formerly Gritstone Oncology, Inc.) (Nasdaq: GRTS), a clinical-stage biotechnology company developing cancer and infectious disease immunotherapies, where she has served on the board of directors since June 2021. Prior to her appointment as President and Chief Executive Officer of Valerio in April 2022, Dr. Agarwal was the Executive Vice President, Chief Medical and Development Officer of Epizyme, Inc. (“Epizyme”), a clinical-stage company developing novel epigenetic therapies for cancer and other serious diseases, where she led the global clinical development and regulatory strategy for tazemetostat for the treatment of cancer from July 2018 to April 2022, and continues to serve as a senior medical advisor and interim Chief Medical and Development Officer. Prior to joining Epizyme in July 2018, Dr. Agarwal served as Chief Medical Officer at SQZ Biotech Inc. between July 2017 and May 2018, where she built and led the clinical development organization, which included clinical research operations and regulatory functions. Dr. Agarwal has also held senior leadership positions at Curis, Inc. from July 2016 to July 2017, where she oversaw the Phase 2 study of its dual HDAC/PI3K inhibitor in diffuse large B-cell lymphoma, and at Tesaro, Inc. from July 2013 to February 2017, where she served as the clinical lead for the New Drug Application and the European Medicines Agency regulatory submissions and supported the commercial launch of ZEJULA® (niraparib) in ovarian cancer. She has also held positions at Covidien plc (acquired by Medtronic, Inc.), AVEO Oncology and Pfizer, and led clinical research in the Department of Anesthesiology and Critical Care Medicine at Johns Hopkins University. Dr. Agarwal received her master’s degree in public health from Johns Hopkins University, her M.S. in business from the University of Baltimore, and her medical degree (M.B.B.S.) from Karnataka University.

The Board of Directors believes Dr. Agarwal is qualified to serve on our Board of Directors due to her extensive experience in the biotechnology industry.

Required Vote

The three (3) nominees for Class II director receiving the highest number of affirmative votes properly cast shall each be elected as a director to serve until the 2027 Annual Meeting of Stockholders or until their successors have been duly elected and qualified. Withheld votes and broker non-votes will have no effect on this proposal.

10

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE ELECTION OF THE THREE NOMINEES FOR CLASS II DIRECTOR LISTED ABOVE.

11

CORPORATE GOVERNANCE

Board of Directors’ Role in Risk Management

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including risks relating to our financial condition, development and commercialization activities, operations and intellectual property. Management is responsible for theday-to-day management of risks we face, on an on-going,day-to-day basis, while our Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The role of our Board of Directors in overseeing the management of our risks is conducted primarily through committees of the Board of Directors, as disclosed in the descriptions of each of the committees below and in the charters of each of the committees. The full Board of Directors (or the appropriate board committee in the case of risks that are under the purview of a particular committee) discusses with management our major risk exposures, their potential impact on our company, and the steps we take to manage them. When a board committee is responsible for evaluating and overseeing the management of a particular risk or risks, the chairman of the relevant committee reports on the discussion to the full Board of Directors during the committee reports portion of the next board meeting. This enables our Board of Directors and its committees to coordinate the risk oversight role, as well as information regarding on-going risk management activities, particularly with respect to risk interrelationships.

Compensation Risk Assessment

We believe that although a portion of the compensation provided to our executive officers and other employees is performance-based, our executive compensation program does not encourage excessive or unnecessary risk taking. This is primarily due to the fact that our compensation programs are designed to encourage our executive officers and other employees to remain focused on both short-term and long-term strategic goals, in particular in connection with ourpay-for-performance compensation philosophy. As a result, we do not believe that our compensation programs are reasonably likely to have a material adverse effect on the Company.

Board of Directors and Committees of the Board

During 2017,2023, the Board of Directors held a total of fourfive meetings. AllDuring the year ended December 31, 2023, each of the directors then in office attended at least 75% of the totalaggregate of the number of Board of Directors meetings and all directors attended at least 75% of the total number of meetings held by all committees of the Board committeesof Directors on which thesuch director served during the time he served on the Board or such committees.served.

Our Board of Directors has determined that all of our directors, except for Mr. Wolchko, are independent, as determined in accordance with the rules of The NASDAQNasdaq Stock Market (“NASDAQ”Nasdaq”) and the SEC. In making such independence determination, the Board of Directors considered the relationships that eachnon-employee director has with us and all other facts and circumstances that the Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by eachnon-employee director. In considering the independence of the directors listed above, our Board of Directors considered the association of our directors with the holders of more than 5% of our common stock. There are no family relationships among any of our directors or executive officers.

The Board of Directors has a standing Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Each of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee is composed entirely of independent directors in accordance with current NASDAQNasdaq listing standards. Furthermore, our Audit Committee meets the enhanced independence standards established by the Sarbanes-Oxley Act of 2002 and related rulemaking of the SEC. Copies of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee charters and our corporate governance guidelinescode of business conduct and ethics are available, free of charge, on our website at http://ir.fatetherapeutics.com/corporate-profile.

Our Board of Directors also has a standing Science & Technology Committee, which is an advisory committee.

12

Audit Committee

Mr. Coughlin Mr. Enyedy and Dr.Drs. Rastetter and Epstein currently serve on the Audit Committee, which is chaired by Mr. Coughlin. Our Board of Directors has designated Mr. Coughlin as an “Audit Committee financial expert,” as defined under the applicable rules of the SEC. Mr. Enyedy, who is not nominated forre-election to our Board of Directors at the Annual Meeting, will cease being a member of our audit committee effective immediately after the Annual Meeting. The Audit Committee’s responsibilities include:

appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm;

| • | approving auditing and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm; |

reviewing the internaloverall audit plan (both internal, if applicable, and external) with the independent registered public accounting firm and members of management responsible for preparing our financial statements;

reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures as well as critical accounting policies and practices used by us;

reviewing the adequacy of our internal control over financial reporting;

establishing policies and procedures for the receipt and retention of accounting-related complaints and concerns;

| • | recommending, based upon the Audit Committee’s review and discussions with management and the independent registered public accounting firm, whether our audited financial statements shall be included in our Annual Report on Form 10-K; |

monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters;

reviewing and discussing with management and the Board items of enterprise risk beyond financial risk and management of financial statements;

preparing or overseeing the Audit Committee report required by SEC rules to be included in our proxy statement for our annual proxy statement;meeting of stockholders;

reviewing all related party transactions for potential conflict of interest situations and approving all such transactions; and

reviewing quarterly earnings releases.releases; and

reviewing, assessing and considering, in consultation with management and the Board of Directors, as appropriate, our overall risk management policies and procedures.

During 2017,2023, the Audit Committee held four meetings.

Compensation Committee

Drs. Jooss and Xu and Mr. Coughlin Mr. Enyedy, Dr. Epstein and Dr. Rastetter currently serve on the Compensation Committee, which is chaired by Mr. Enyedy. Mr. Enyedy, who is not nominated forre-election to our BoardDr. Jooss. Dr. Jooss was appointed as Chairperson of Directors at the Annual Meeting, will cease beingCompensation Committee and Dr. Xu was appointed as a member of our compensation committee effective immediately after the Annual Meeting.Compensation Committee in February 2023. Dr. Mendlein previously served as a member and Chairperson of the Compensation Committee from May 2018 to February 2023. The Compensation Committee’s responsibilities include:

reviewing and approving, or upon the request of the Board of Directors, reviewing and recommending for approval by the Board of Directors, the corporate goals and objectives relevant to the compensation of our Chief Executive Officer and our other executive officers;(“CEO”);

13

evaluating the performance of our Chief Executive OfficerCEO in light of such corporate goals and objectives and recommendingdetermining and approving, or at the compensationrequest of our Chief Executive Officerthe Board of Directors, recommending to the Board of Directors for approval;based on such evaluation, the compensation of our CEO;

reviewing and approving the compensation, including with respect to any cash compensation (including severance), incentive compensation plans, equity-based plans, perquisites and other benefits, of our other executive officers;officers and at the discretion of the Compensation Committee, other members of senior management;

designing and developing the Company’s overall compensation structure, policies and programs applicable to directors, executives and employees;

reviewing management’s aggregate decisions regarding the compensation of our employees, other than executive officers;officers, provided, that the foregoing does not limit or restrict the authority of the Compensation Committee to review and approve compensation for all such employees;

| • | overseeing and administering our incentive compensation and equity-based plans for employees and approving all forms of award agreement and/or sub-plans adopted thereunder; |

evaluating and assessing potential and current compensation advisers in accordance with the independence standards identified in the applicable NASDAQNasdaq and SEC rules;

retaining and approving the compensation of any compensation advisers;

reviewing and approving our policies and procedures for the grant of equity-based awards; and

reviewing and making recommendations to the Board of Directors with respect to director compensation.compensation;

Pursuant

reviewing our overall employee compensation structure, policies and programs, plans, and short and long-term strategies with respect to its charter, the Compensation Committee has the authority to retain compensation consultants to assist in its evaluation of executive and director compensation. The Compensation Committee engaged Radford as a compensation consultant to perform compensation advisory services during 2017. The Compensation Committee instructed the consultant to conduct an independent evaluation of the Company’s existing peer group of companies and provide recommended changes to the peer group to assess the competitiveness of the Company’s executive, equity and Board of Directors compensation programs and to review the Company’s equity program and broader equity practices. Our Compensation Committee plans to retain a consultant to provide similar information and advice in future years for consideration in determining annualany cash, equityincentives and other compensation for our employees, executive officersplans, and directors. We do not believe the retention of,with respect to healthcare-related and the work performed by, Radford creates any conflict of interest.other benefit programs; and

Pursuant to our 2013 Equity Incentive Plan (the “2013 Plan”), the Compensation Committee has delegated to our Chief Executive Officer the authority to approve grants of stock options or restricted stock units to new hires, subject to certain limitations for each level of employment and an annual aggregate maximum amount of awards that can be granted pursuant to such delegated authority.

| • | administering and, if determined to be necessary, amending our 401(k) plan, and any other material non-equity-based compensation plan; provided that the Compensation Committee may delegate routine administration of such plans to an administrative committee consisting of one or more of our officers or other employees. |

During 2017,2023, the Compensation Committee held fivenine meetings.

Nominating and Corporate Governance Committee

Drs. Nashat, RastetterEpstein, Agarwal, and MendleinHershberg currently serve on the Nominating and Corporate Governance Committee, which is chaired by Dr. Rastetter.Epstein. Dr. Mendlein joinedXu previously served as a member of the Nominating and Corporate Governance Committee in March 2016.from February 2022 to February 2023. The Nominating and Corporate Governance Committee’s responsibilities include:

developing and recommending to the Board of Directors criteria for board and committee membership;

establishing procedures for identifying and evaluating Board of Director candidates, including nominees recommended by stockholders;

identifying individuals qualified to become members of the Board of Directors;

recommending to the Board of Directors the persons to be nominated for election as directors and to each of the board’s committees;

developing and recommending to the Board of Directors a set of corporate governance guidelines; and

overseeing the evaluation of the Board of Directors.

14

During 2017,2023, the Nominating and Corporate Governance Committee held one meeting.two meetings.

Science & Technology Committee (Advisory)

Our Board of Directors formed a Science & Technology Committee in September 2019. Drs. Agarwal, Jooss, Hershberg, Mendlein, and Xu and Mr. Lee currently serve on the Science & Technology Committee, which is chaired by Dr. Agarwal. The Science & Technology Committee’s responsibilities include assisting the Board of Directors’ oversight of our research and development activities and advising the Board of Directors with respect to strategic and clinical considerations.

Board Leadership

The positions of our Chairman of the Board of Directors and Chief Executive OfficerCEO are presently separated at Fate. Separating these positions allows our Chief Executive OfficerCEO to focus on ourday-to-day business, while allowing the Chairman of the Board of Directors to lead our Board of Directors in its fundamental role of providing advice to and independent oversight of management. Our Board of Directors recognizes the time, effort and energy that the Chief Executive OfficerCEO must devote to his position in the current business environment, as well as the commitment required to serve as our Chairman of the Board of Directors, particularly as our Board of Directors’ oversight responsibilities continue to grow. Our Board of Directors also believes that this structure ensures a greater role for the independent directors in the oversight of our Company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of our Board of Directors.

While our Bylaws and corporate governance guidelines do not require that our Chairman of the Board of Directors and Chief Executive OfficerCEO positions be separate, our Board of Directors believes that having separate positions and having an independent outside director serve as Chairman of the Board of Directors is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance. Our separatedseparate Chairman of the Board of Directors and Chief Executive OfficerCEO positions are augmented by the independence of sixnine of our seventen directors, and our three entirely independent Board committees that provide appropriate oversight in the areas described above. At executive sessions of independent directors, these directors speak candidly on any matter of interest, without the Chief Executive OfficerCEO or other executives present. The independent directors met fourthree times in 20172023 without management present. We believe this structure provides consistent and effective oversight of our management and the Company.

Board Diversity

Our Board of Directors believes that directors who provide a significant breadth of experience, knowledge and abilities in areas relevant to our business, while also representing a diversity in race, ethnicity and gender, contribute to a well-balanced and effective board. Presently, three of our directors self-identify as female and three directors self-identify as having a demographic background from an underrepresented community.

As required by rules of the Nasdaq Stock Market that were approved by the Securities and Exchange Commission in August 2021, we are providing information about the gender and demographic diversity of our directors in the format required by Nasdaq rules. The information in the matrix below is based solely on information provided by our directors about their gender and demographic self-identification. Directors who did not answer or indicated that they preferred not to answer a question are shown as “did not disclose gender” or “did not disclose demographic background” below.

To see our Board Diversity Matrix as of April 1, 2023, please refer to our definitive proxy statement filed with the SEC on April 21, 2023.

15

| Board Diversity Matrix (As of April 1, 2024) | ||||||||||||||||

Total Number of Directors | 10 | |||||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||||

Part I: Gender Identity | ||||||||||||||||

Directors | 3 | 7 | 0 | 0 | ||||||||||||

Part II: Demographic Background | ||||||||||||||||

Asian | 2 | 1 | 0 | 0 | ||||||||||||

White | 1 | 6 | 0 | 0 | ||||||||||||

Did Not Disclose Demographic Background | 0 | |||||||||||||||

Director Nominations

The director qualifications developed to date focus on what our Board of Directors believes to be essential competencies to effectively serve on the Board of Directors. The Nominating and Corporate Governance Committee must reassess such criteria annually and submit any proposed changes to the Board of Directors for approval. Presently, at a minimum, the Nominating and Corporate Governance Committee must be satisfied that each nominee it recommends has the highest personal and professional integrity, demonstrates exceptional ability and judgment and shall be most effective, in conjunction with the other nominees to the Board of Directors, in collectively serving the long-term interests of the stockholders.

In addition to those minimum qualifications, the Nominating and Corporate Governance Committee recommends that our Board of Directors select persons for nomination to help ensure that:

a majority of our Board of Directors is “independent” in accordance with NASDAQNasdaq standards;

each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee be comprised entirely of independent directors; and

at least one member of the Audit Committee shall have the experience, education and other qualifications necessary to qualify as an “Audit Committee financial expert” as defined by the rules of the SEC.

In addition to other standards the Nominating and Corporate Governance Committee may deem appropriate from time to time for the overall structure and compensation of the Board of Directors, the Nominating and Corporate Governance Committee may considerconsiders the following factors when recommending that our Board of Directors select persons for nomination:

whether a nominee has direct experience in the biotechnology or pharmaceuticals industry or in the markets in which the Company operates; and

16

whether the nominee, if elected, assists in achieving a mix of Boardboard members that represents a diversity of background and experience.experience; and

Although

achieving diversity within the NominatingBoard of Directors and Corporate Governance Committee may consider whether nominees assist in achievingadhering to the philosophy of maintaining an environment free from discrimination on the basis of race, color, religion, sex, sexual orientation, gender identity, age, national origin, disability, veteran status or any protected category under applicable law, which would include considering a mix of Board members that represents a diversity ofnominee’s diverse background, skills and experience, which is not only limitedincluding appropriate financial, scientific, medical and other expertise relevant to race, gender or national origin, we have no formal policy regarding board diversity.our business.

The Nominating and Corporate Governance Committee adheres to the following process for identifying and evaluating nominees for the Board of Directors. First, it solicits recommendations for nominees fromnon-employee directors, our Chief Executive Officer,CEO, other executive officers, third-party search firms or any other source it deems appropriate. The Nominating and Corporate Governance Committee then reviews and evaluates the qualifications of proposed nominees and conducts inquiries it deems appropriate; all proposed nominees are evaluated in the same manner, regardless of who initially recommended such nominee. In reviewing and evaluating proposed nominees, the Nominating and Corporate Governance Committee may consider, in addition to the minimum qualifications and other criteria for Boardboard membership approved by our Board of Directors from time to time, all facts and circumstances that it deems appropriate or advisable, including, among other things, the skills of the proposed nominee, his or her depth and breadth of business experience or other background characteristics, his or her independence and the needs of the Board.Board of Directors. This process is designed to provide that the Board of Directors includes members with diverse backgrounds, skills and experience, including appropriate financial, scientific, medical and other expertise relevant to the business of the Company. Additionally, the Nominating and Corporate Governance Committee considers whether nominees assist in achieving a mix of board members that represents a diversity of background and experience, which is not only limited to race, gender or national origin, and is committed to actively seeking out highly qualified women and minority candidates, as well as candidates with diverse backgrounds, skills and experiences, to include in the pool from which board nominees are chosen. The Nominating and Corporate Governance Committee assesses its own performance on a periodic basis, and in doing so, gives consideration to its implementation of, and the results achieved through, this process.

If the Nominating and Corporate Governance Committee decides to retain a third-party search firm to identify proposed nominees, it has sole authority to retain and terminate such firm and to approve any such firm’s fees and other retention terms.

Each nominee for election as director at the 20182024 Annual Meeting is recommended by the Nominating and Corporate Governance Committee and is presently a director and stands forre-election by the stockholders. From time to time, the Company may pay fees to third-party search firms to assist in identifying and evaluating potential nominees, although no such fees have been paid in connection with nominations to be acted upon at the 20182024 Annual Meeting.

Pursuant to our Bylaws, stockholders who wish to nominate persons for election to the Board of Directors at an annual meeting must be a stockholder of record at the time of giving the notice, entitled to vote at the meeting, present (in person or by proxy) at the meeting and must comply with the notice procedures in our Bylaws. A stockholder’s notice of nomination to be made at an annual meeting must be delivered to our principal executive offices not less than 90 days nor more than 120 days before the anniversary date of the immediately preceding

annual meeting. However, if an annual meeting is more than 30 days before or more than 60 days after such anniversary date, the notice must be delivered no later than the later of the 90th day prior to such annual meeting or the 10th day following the day on which the first public announcement of the date of such annual meeting was made. A stockholder’s notice of nomination may not be made at a special meeting unless such special meeting is held in lieu of an annual meeting. The stockholder’s notice must include the following information for the person making the nomination:

name and address;

17

the class and number of shares of the Company owned beneficially or of record;

disclosure regarding any derivative, swap or other transactions which give the nominating person economic risk similar to ownership of shares of the Company or provide the opportunity to profit from an increase in the price of value of shares of the Company;

any proxy (other than a revocable proxy given in response to a public proxy solicitation made pursuant to, and in accordance with, the Exchange Act), agreement, arrangement, understanding or relationship that confers a right to vote any shares of the Company;

any agreement, arrangement, understanding or relationship engaged in for the purpose of acquiring, holding, disposing or voting of any shares of any class or series of capital stock of the Company;

any rights to dividends on the shares that are separate from the underlying shares;

any performance related fees that the nominating person is entitled to, based on any increase or decrease in the value of any shares of the Company;

a description of all agreements, arrangements or understandings by and between the proposing stockholder and another person relating to the proposed business (including an identification of each party to such agreement, arrangement or understanding and the names, addresses and class and number of shares owned beneficially or of record of other stockholders known by the proposing stockholder support such proposed business);

a statement whether or not the proposing stockholder will deliver a proxy statement and form of proxy to holders of, in the case of a business proposal, at least the percentage of voting power of all shares of capital stock required to approve the proposal or, in the case of director nominations, at least the percentage of voting power of all of the shares of capital stock reasonably believed by the proposing stockholder to be sufficient to elect the nominee; and

any other information relating to the nominating person that would be required to be disclosed in a proxy statement filed with the SEC.